Great things in business are never done by one person. They’re done by a team of people. We have that dynamic group of peoples

This article delves into the rapidly evolving world of OLED microdisplays, a cutting-edge display technology that’s transforming how we interact with digital information. We’ll explore the leading microdisplay companies and OLED microdisplay suppliers driving innovation in this field, particularly focusing on the landscape of 2025. From AR and VR headsets to advanced automotive applications, OLED microdisplays offer unparalleled visual experiences and are set to redefine various industries. This article is worth reading because it provides a comprehensive overview of the microdisplay industry, highlights key players, and offers insights into the future of this transformative technology and how it will impact our lives.

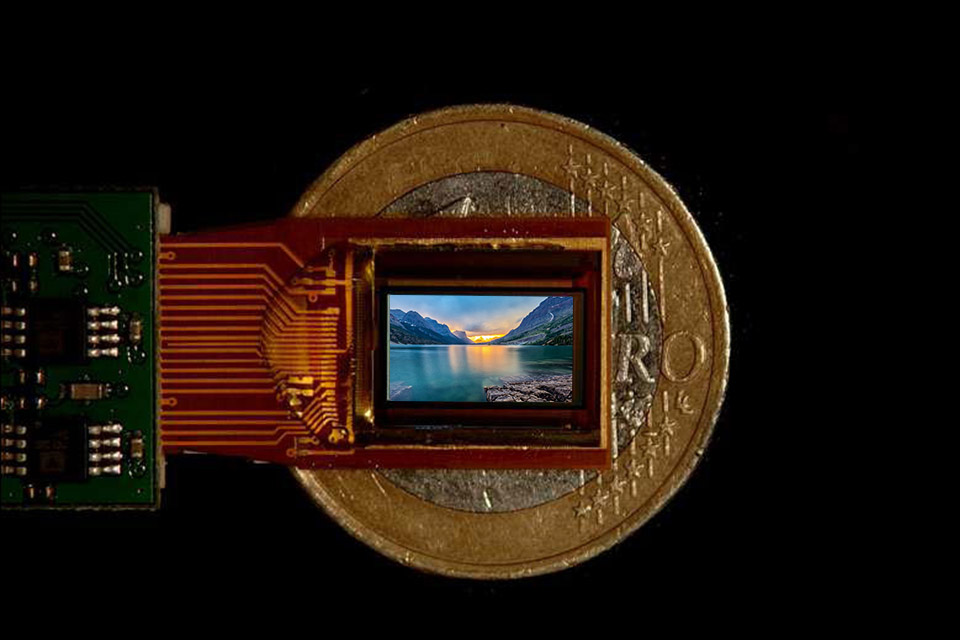

OLED microdisplays are miniature displays that utilize organic light-emitting diodes (OLED) as their light source. Unlike traditional LCD displays that rely on a backlight, OLEDs are self-emissive, meaning each pixel generates its own light. This fundamental difference leads to several advantages, including superior contrast ratios, faster response times, wider viewing angles, and the ability to achieve true blacks. Microdisplays, as the name suggests, are incredibly small, typically measuring less than an inch diagonally. They are designed to be viewed through magnifying optics, such as those found in head-mounted displays, electronic viewfinders, and other near-eye applications.

The importance of OLED microdisplays stems from their ability to deliver high-resolution, high-brightness, and power-efficient images in a compact form factor. They are crucial for creating immersive and realistic visual experiences in AR and VR applications. The self-emissive nature of OLED allows for thinner and lighter devices, contributing to user comfort, especially in wearable technology like VR headsets. Furthermore, the fast response times of OLED microdisplays help minimize motion blur, enhancing the realism of fast-paced content in gaming and simulations. The exceptional image quality and efficiency of oled microdisplays are leading to adoption in different applications, like head-up displays in automotive.

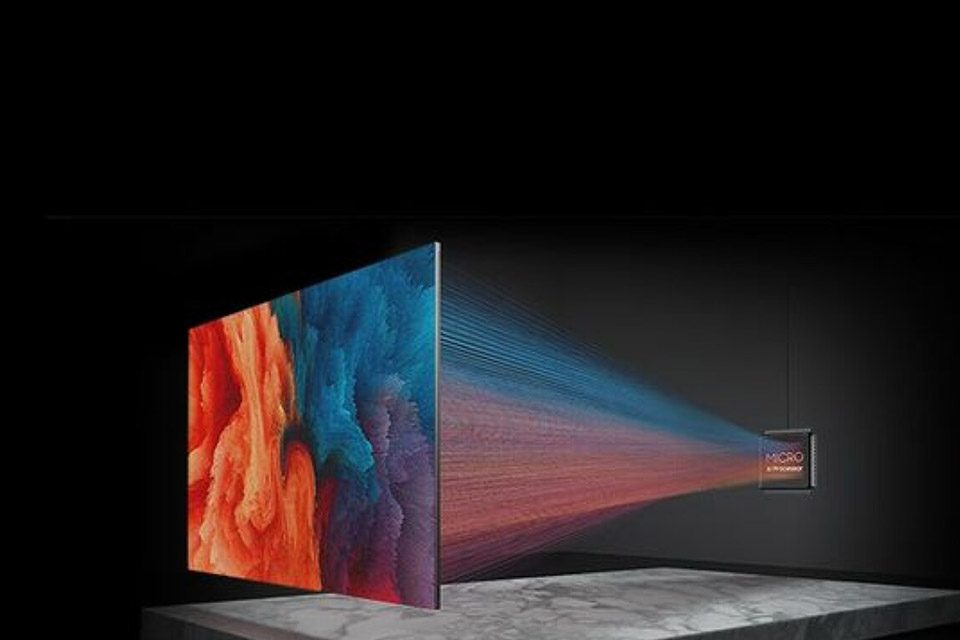

The global microdisplay market is experiencing significant growth, fueled by increasing demand across various applications. One of the primary drivers is the burgeoning AR and VR market. VR headsets rely heavily on microdisplays to create immersive virtual environments. As VR technology becomes more sophisticated and affordable, the demand for high-performance OLED microdisplays is expected to surge. Similarly, AR applications, which overlay digital information onto the real world, are gaining traction in industries like healthcare, manufacturing, and education. AR glasses and head-mounted displays require compact, high-resolution displays, making OLED microdisplays an ideal choice.

Beyond AR and VR, OLED microdisplays are finding applications in other areas. In the automotive industry, microdisplays are used in head-up displays (HUDs) that project crucial information, such as speed and navigation, onto the windshield, allowing drivers to keep their eyes on the road. Military and defense applications also utilize microdisplays in electronic viewfinders for cameras, thermal imaging devices, and night vision goggles. Additionally, OLED microdisplays are used in medical imaging equipment, providing high-resolution images for surgical procedures. With the emergence of 4K displays, the demand for microdisplays with higher pixel density (PPI) will become even greater, driving innovation in OLED microdisplay technology.

The OLED microdisplay market is characterized by a few key players who dominate the landscape. Sony is a major force, known for its high-quality OLED panels and its expertise in semiconductor technology. Sony Semiconductor Solutions, a subsidiary of Sony Group, is a leading supplier of OLED microdisplays for VR headsets and other applications. eMagin Corporation is another prominent manufacturer of active-matrix organic LED microdisplays, specializing in high-resolution displays for military, industrial, and medical markets. Kopin Corporation is recognized as the biggest microdisplay supplier. The company provides a wide range of microdisplay technologies, including OLED, LCD, and LCOS.

Here is a table summarizing the leading OLED microdisplay manufacturers:

| Manufacturer | Key Strengths | Target Markets |

|---|---|---|

| Sony | High-quality OLED panels, semiconductor expertise, strong brand recognition | VR headsets, electronic viewfinders, automotive HUDs |

| eMagin Corporation | High-resolution OLED microdisplays, focus on military, industrial, and medical markets | Military, industrial, medical, AR/VR |

| Kopin Corporation | Broad portfolio of microdisplay technologies (OLED, LCD, LCOS), strong partnerships, focus on innovation | AR/VR headsets, enterprise wearables, military and defense applications, consumer electronics |

| Seeya Technology | Cost-effective OLED microdisplays, strong presence in the Chinese market, rapid growth | AR/VR headsets, consumer electronics |

| Samsung Display | Large-scale OLED manufacturing capacity, expertise in display technologies, focus on mobile and consumer electronics | Smartphones, tablets, wearables, potential expansion into microdisplays |

eMagin Corporation has established itself as a leading provider of OLED microdisplays, particularly for demanding applications that require high brightness, high resolution, and exceptional image quality. The company offers a range of microdisplay products tailored to the needs of military, industrial, medical, and, increasingly, AR and VR markets. One of eMagin’s key strengths is its proprietary direct patterning technology, which enables the creation of high-pixel-density displays with superior brightness and low power consumption. This technology also allows for the integration of a color filter onto the OLED emitter, simplifying the design and reducing the cost of the display module.

eMagin is known for its commitment to research and development, constantly pushing the boundaries of OLED microdisplay technology. The company has achieved significant milestones, such as developing the world’s first 4K (3840×2160 pixels) OLED microdisplay and demonstrating displays with brightness levels exceeding 10,000 nits, which is crucial for outdoor AR applications. In the VR space, eMagin’s high-resolution oled microdisplays enable more immersive and realistic virtual environments in head-mounted displays. The company’s focus on innovation and its ability to deliver cutting-edge microdisplay solutions have positioned it as a key player in the microdisplay industry.

Sony is a dominant force in the electronics industry, and its expertise in OLED technology and semiconductor manufacturing has made it a significant player in the OLED microdisplay market. Sony Semiconductor Solutions, a subsidiary of Sony Group, is a leading supplier of OLED microdisplays for a variety of applications, including VR headsets, electronic viewfinders, and industrial head-mounted displays. Sony’s OLED microdisplays are renowned for their exceptional image quality, characterized by high contrast ratios, vibrant colors, and fast response times. The company’s advanced OLED deposition techniques and silicon backplane technology enable the creation of high-resolution displays with excellent uniformity and brightness.

Sony has made significant contributions to the advancement of OLED microdisplay technology. For example, the company recently announced the development of a high-definition 1.3-type OLED microdisplay with 4K resolution, specifically designed for VR applications. This 1.3-type OLED microdisplay with 4K resolution boasts an impressive pixel density and a high refresh rate, enabling smooth and immersive VR experiences. Sony’s commitment to innovation and its ability to leverage its vast resources in semiconductor manufacturing have positioned it as a leader in the OLED microdisplay market.

Kopin Corporation has a long history in the microdisplay industry, dating back to the early days of head-mounted displays. The company is known for its broad portfolio of microdisplay technologies, including transmissive LCD, reflective LCOS, and, more recently, OLED on silicon. Kopin’s expertise spans the entire microdisplay value chain, from designing and manufacturing display chips to developing optical modules and complete display systems.

Kopin remains a relevant player in the microdisplay market, particularly in the AR and enterprise wearables segments. The company provides microdisplay solutions for a wide range of applications, including industrial head-mounted displays, smart glasses, and thermal weapon sights. Kopin’s strength lies in its ability to tailor its microdisplay offerings to the specific needs of its customers. For example, the company offers OLED modules with integrated optics and electronics, simplifying the integration process for device manufacturers. While Kopin faces competition from other microdisplay companies, its experience, diverse technology portfolio, and strong partnerships keep it in the game.

While established companies like Sony, eMagin, and Kopin dominate the OLED microdisplay market, several emerging players are making waves with innovative technologies and approaches. One such company is Seeya Technology, a Chinese microdisplay manufacturer that has gained significant traction in recent years. Seeya Technology offers a range of cost-effective OLED microdisplays targeting the AR and VR markets. The company’s rapid growth and strong presence in the Chinese market make it a competitor to watch.

Another company to keep an eye on is Samsung Display. Although primarily known for its large-format OLED panels for smartphones and televisions, Samsung Display has the potential to become a major player in the OLED microdisplay market. The company’s vast OLED manufacturing capacity and expertise in display technology could enable it to produce high-volumes of microdisplays at competitive prices. There are even rumors about agreement with Samsung Display to become a major force in microdisplay production. Other notable emerging players include BOE Technology Group and LG Display, both of which are investing in OLED microdisplay research and development.

The microdisplay industry is witnessing a growing debate between two competing technologies: OLED and MicroLED. While OLED microdisplays are currently the dominant technology for high-end AR and VR applications, microLED displays are emerging as a potential challenger. MicroLED technology utilizes microscopic LEDs as individual pixels, offering several advantages over OLED, including higher brightness, longer lifespan, and improved power efficiency. MicroLED displays also have the potential to achieve even higher pixel density, making them suitable for ultra-high-resolution applications.

However, microLED technology is still in its early stages of development, and several technical challenges need to be overcome before it can be widely adopted in microdisplays. One of the main hurdles is the mass transfer process, which involves transferring millions of microscopic LEDs onto a backplane with high precision and yield. This process is complex and costly, making microLED displays currently more expensive than OLED counterparts. Additionally, microLED technology faces challenges in achieving uniform brightness and color across the entire display. While it is unlikely that OLED will be replaced, it might lose some market share to microLED.

Producing OLED microdisplays presents several technical challenges that manufacturers must overcome to achieve high yields, performance, and reliability. One of the primary challenges is the deposition of organic materials with high precision and uniformity onto a silicon wafer. OLED materials are sensitive to moisture and oxygen, requiring specialized encapsulation techniques to prevent degradation and ensure long-term stability. Achieving high pixel density in microdisplays also requires advanced lithography and etching processes to create the intricate circuitry on the silicon backplane.

Another challenge is the integration of OLED emitters with the underlying semiconductor circuitry. The OLED stack, consisting of multiple organic layers, must be carefully aligned with the driving transistors on the backplane to ensure proper operation of each pixel. Additionally, achieving high brightness in OLED microdisplays can be challenging due to the limited current-carrying capacity of the organic materials. Manufacturers are constantly researching new materials and device architectures to improve the efficiency and brightness of OLEDs.

Microdisplay Production Challenges

| Challenge | Description | Solutions |

|---|---|---|

| OLED Material Deposition | Depositing organic materials with high precision and uniformity onto a silicon backplane while maintaining their integrity. | Advanced deposition techniques like fine metal mask (FMM) evaporation, inkjet printing, and laser-induced thermal imaging (LITI). Development of more stable and efficient OLED materials. |

| Encapsulation | Protecting OLED materials from moisture and oxygen, which can degrade their performance and lifespan. | Thin-film encapsulation (TFE) using multiple layers of inorganic and organic materials. Development of new encapsulation materials and processes with improved barrier properties. |

| High Pixel Density | Achieving high pixel density requires advanced lithography and etching processes to create intricate circuitry on the silicon backplane. | High-resolution lithography techniques like deep ultraviolet (DUV) lithography and electron beam lithography. Development of new etching processes with high selectivity and anisotropy. |

| OLED-Semiconductor Integration | Aligning the OLED stack with the driving transistors on the backplane to ensure proper operation of each pixel. | Self-aligned processes and advanced alignment techniques. Development of new device architectures that simplify the integration process. |

| Brightness and Efficiency | Achieving high brightness in OLED microdisplays can be challenging due to the limited current-carrying capacity of organic materials. | Development of new OLED materials with higher efficiency and longer lifespan. Optimization of device architecture to improve light extraction and reduce power consumption. Use of tandem OLED structures to increase brightness. |

| Color Purity and Accuracy | Achieving accurate and vibrant colors in OLED microdisplays requires precise control of the emission spectrum of each OLED subpixel. | Development of new OLED materials with narrow emission spectra. Use of color filters or color-by-white approaches to achieve full-color displays. Advanced color management techniques to ensure accurate color reproduction. |

| Yield and Cost | Achieving high manufacturing yields and reducing production costs are crucial for the commercial success of OLED microdisplays. | Optimization of manufacturing processes to minimize defects and improve uniformity. Development of new materials and processes that are more cost-effective. Scaling up production to achieve economies of scale. |

| Driving Circuitry Design | Designing driving circuitry that can deliver high currents and voltages to the OLED pixels while minimizing power consumption and heat generation. | Development of new driving schemes like pulse-width modulation (PWM) and current-steering techniques. Use of low-power circuit designs and advanced power management techniques. Integration of driving circuitry directly onto the silicon backplane using CMOS technology. |

| Thermal Management | Dissipating heat generated by the OLED pixels and driving circuitry to prevent overheating and maintain device performance. | Use of high thermal conductivity materials for the backplane and encapsulation. Integration of micro-cooling channels or other thermal management solutions into the display module. Optimization of driving circuitry to reduce power consumption and heat generation. |

| Reliability and Lifespan | Ensuring long-term stability and reliability of OLED microdisplays, especially in demanding applications like automotive and military. | Development of new OLED materials and encapsulation techniques with improved resistance to degradation. Rigorous testing and qualification procedures to ensure device performance and lifespan under various operating conditions. |

The global microdisplay market is poised for significant growth in the coming years, driven by increasing demand from AR, VR, and other emerging applications. According to market research reports, the microdisplay market is projected to reach USD 1.3 billion in 2025 to USD 3.0 billion by 2029, growing at a compound annual growth rate (CAGR) of over 20% during the forecast period. This growth will be fueled by several factors, including the increasing adoption of AR and VR headsets, the growing use of microdisplays in automotive applications, and the development of new microdisplay technologies like microLED.

In the near term, OLED microdisplays are expected to continue to dominate the market, particularly in high-end AR and VR applications. However, microLED displays are likely to gain traction as the technology matures and production costs decrease. By the end of the decade, microLED could potentially challenge OLED in certain segments of the microdisplay market. The microdisplay industry will also witness increased competition, with new players entering the market and established companies expanding their product portfolios.

Here are the 10 most important things to remember about OLED microdisplays and their suppliers:

OLED display modules, particularly graphic OLED variants, are revolutionizing the way we interact with devices, offering crisp visuals, vibrant colors (in some cases), and exceptional energy efficiency.

This article delves into the rapidly evolving world of OLED microdisplays, a cutting-edge display technology that’s transforming how we interact with digital information.

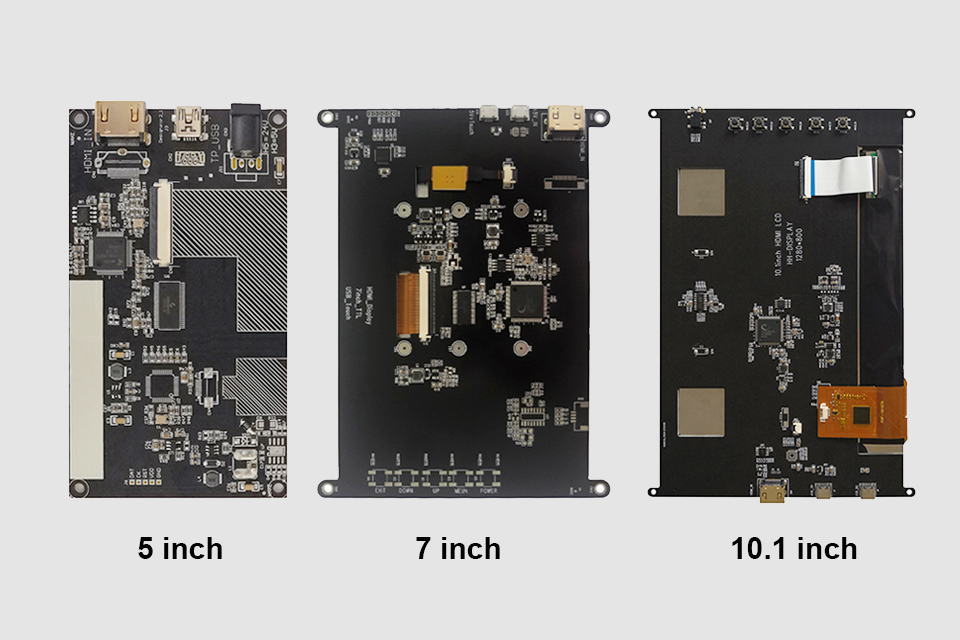

This article dives deep into the world of LCD controller boards, offering you the essential knowledge to select the perfect board for your display project, whether you’re repurposing a laptop screen or building a custom monitor.

This article dives deep into the world of micro-OLED and microLED microdisplays, exploring their technology, applications, and the significant role they play in shaping the future of AR and VR, especially in devices like the Apple Vision Pro.

This article dives deep into the world of interfacing a 16×2 LCD module with microcontrollers like Arduino and ESP32, specifically focusing on the setup without using an I2C module.

This article explores how to connect an LCD screen to a Raspberry Pi using an HDMI driver board, essentially turning your single-board computer into a miniature HDMI monitor.

This article dives into the exciting world of augmented reality (ar) lenses, specifically focusing on the development and potential of an interchangeable lens system for ar glasses.

This article dives deep into the lifespan and durability of OLED (Organic Light Emitting Diode) displays compared to LCD (Liquid Crystal Display) screens.

@ 2025 display-module. All right reserved.

Fill out the form below, and we will be in touch shortly.